Welcome to K & C Developments

Professional Credit Consulting

Our dedicated team of experts will be more than happy to answer any questions you may have about your credit. We will give consultation and advise you on your credit to make sure you have the best chance at an increase.

“Helping families grow their credit strong to enrich their lives.”

UNPARALELLED INTEGRITY

We are a family-owned company. You will experience the values in our work by providing sincere credit repair service.

FAST & RELIABLE SERVICE

The plan is so simple, you can implement it immediately. You can achieve a high credit score successfully using our unique method.

STRONG CLIENT FOCUS

Each client is different. We customize our approach depending on your needs, goals, and vision. You will

You don’t need a team of lawyers to repair your credit. You just need the right tools to get the credit you deserve, and that’s where we come in. So let’s get together and start working to repair your credit.

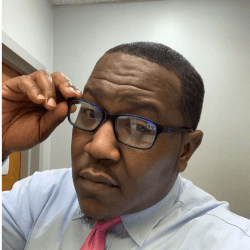

Kyle & Christine Kennedy

Why K & C Developments?

but we’d rather let our results do the talking

Strong Years

States

Happy Clients

Successful Disputes

About Us

We are a family-owned and operated business that focuses on the future prosperity of other families.

The biggest, direct beneficiary of your good credit is your family. We make sure you succeed in that.

Results are granted to those who take action.

Let's move forward and fix your credit. how do you want to get started?

Testimonial

Your satisfaction fuels us.

There’s nothing more satisfying than hearing the kind words that motivate us.

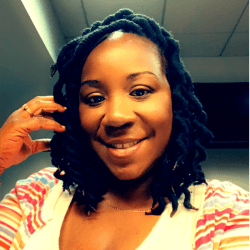

I definitely will continue to work with K & C because they get results and they continue to extend their services when things come up that negatively impact your credit.

K & C has been a blessing to our family.

FAQ

Frequently Ask Questions

Knowledge is power. To save you significant time, here are some answers to the common questions regarding our company, our service, and credit repair in general.

There is no one-size-fits-all approach when it comes to our clients' needs. The credit status and difficulty level of each account can vary, so it's best to schedule a consultation so we can assess your needs accurately. >> Book a Consultation Now <<

We accept all major credit cards and PayPal.

A credit score is a number between 300 and 850 that tells lenders how likely you are to repay a loan. A high score means you're a low-risk borrower, which could lead to a lower interest rate on a loan. A low score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

You need a credit score that's not lower than 650.

There are a few common reasons:

- You could have a recent late payment account, which could negatively impact your credit score.

- You could also have a new negative account come up on your credit report.

- A deleted account was placed back on your credit report as a new collection account.

- If a negative account is deleted but your credit report does not have any positive accounts.

- The 30% Utilization Rule applies to credit cards.

There could be other reasons too. We can discuss more during the consultation.

An account in good standing that you have always paid on time and never had a late payment even once.

It is primarily based on your credit score. The lowest credit score one can have is a 300. And the highest one can score is 800. Anything in between 300 and 620 is considered bad credit.

The 700 Club is a designation we give to clients whose scores fall within the 700-799 range. This is the score range we aim for.