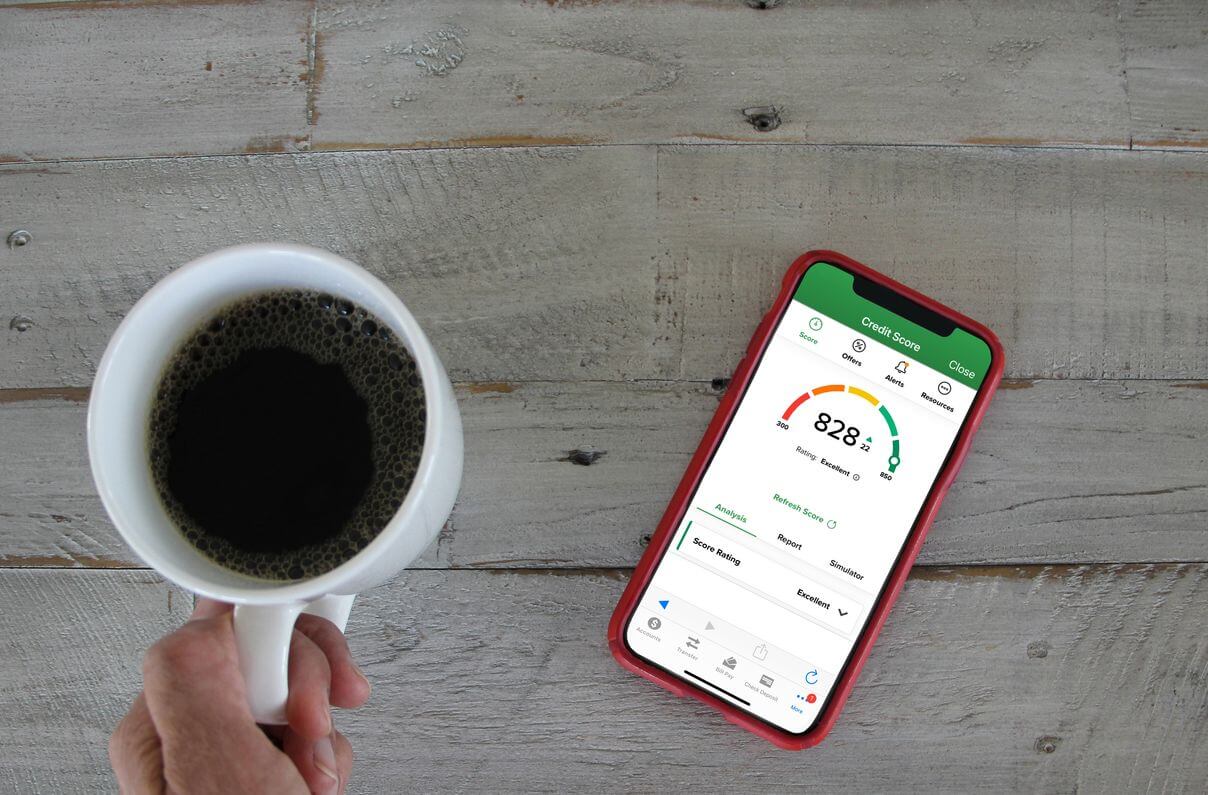

We all want good credit, but not everyone has it. A decent FICO assessment can help you get better rates and save money. A strong score can provide access to greater opportunities, including jobs, affordable housing, protection from identity theft, and approval for a passport. It is possible to have good credit without a high income. You do need to make some financial moves, like spending responsibly, paying your bills on time, and keeping your credit utilization ratios low. There are many benefits to having a good credit score, and you don’t need to spend a fortune to achieve it. This article provides a few common benefits of having a decent credit score.

Increase Employment Potential

In any case, it is simpler to discover new work on the positive side that you have great credit. With regards to recruiting, organizations need to realize that they are welcoming the best individuals. It is important to check an up-and-comer’s record as a consumer before sending them an offer letter. Various organizations should play out a credit check with your permission.

Bigger Credit Capacity

It is crucial to check an up-and-comer’s record as a consumer before sending them an offer letter. Various organizations should play out a credit check with your permission. While a good credit score can increase your chances of being approved for a credit card or loan, the benefits don’t stop there. A good FICO score can also help you get approved for higher credit limits, larger loans, and benefits.

Banks feel confident lending money to borrowers with great financial assessments, because they believe these borrowers will repay their obligations. By allowing them access to more funds, banks are able to show their trust in these individuals. Also, with great credit, borrowers can take advantage of money-back projects, lower loan fees, or prize focuses offered by banks.

The advantages of this arrangement are beneficial to both the bank and the borrower. The bank will receive payments from the accumulated premiums, while the borrower will reap the rewards from the various advantages. Additionally, on-time installments will improve the borrower’s financial assessment.

Lower Interests

A higher credit score will result in lower interest rates on your credit cards and other loans. This means that you will spend less money on interest and have smaller monthly payments. When you have a lower loan fee, it becomes much easier to handle your obligation, which creates a positive cycle–better credit makes your obligation easier to manage, which in turn improves your credit even further.

Higher Loan Approval Rate

A good FICO score increases your chances of getting approved for credit cards and loans. If you’re applying for a Visa or an advance, your FICO rating will be a key factor in whether or not the bank approves your application.

Candidates with poor credit (or no financial assessments) may be considered high-risk borrowers and, as a result, may be less likely to be approved for a loan or credit card. Meanwhile, candidates with high FICO scores will be seen as less of a risk and therefore more attractive to lenders, increasing their chances of being approved.

Less Processing Fees

Loan specialists see that you are a responsible borrower who pays their bills on time. Most loan specialists will offer you lower interest rates as a result. If you have a lower interest rate, you may end up paying less money in the long run compared to someone with a average or low credit score.

Auto Loans Advantages

Credit may play a role in how much you pay for car insurance. While an insurer can’t deny you coverage based on your credit history, you’re more likely to get lower rates if your credit is good. Insurance agencies accept that individuals with helpless credit document more cases and if this is valid, the truth of the matter is that if you have awful credit you will wind up paying more for your vehicle protection.

Better Negotiating Position

An individual with great credit is a valuable asset to a bank because they are more likely to get their loan repaid. If you have great credit and are looking for a loan, banks will be more interested in your business. If you have a good credit score, you can use it to negotiate for better interest rates, more favorable repayment plans, and higher credit limits.

Conclusion

There’s no denying that your credit score has a big impact on your life in many ways. Thankfully, there are great service providers like K & C Developments that can make the process a lot easier.

We hope this article gives you enough value to start working on your credit status. We wish you all the best!