There is a common misconception about repairing credit. Many people think that you need to make payments on debts to fix your credit. However, this is not the only way to improve your credit score. Reducing the amount of debt you owe can also have a positive impact on your credit score. There are other things you can do to improve your credit score. For example, if you have any collections accounts, you should try to pay them off. If you have bad credit, make sure there are no negative items on your credit report. If you’re looking to improve your financial situation, we can help you out with some tips and tricks for repairing your credit. With our help, you can get back on track and improve your overall financial health!

What do you really owe?

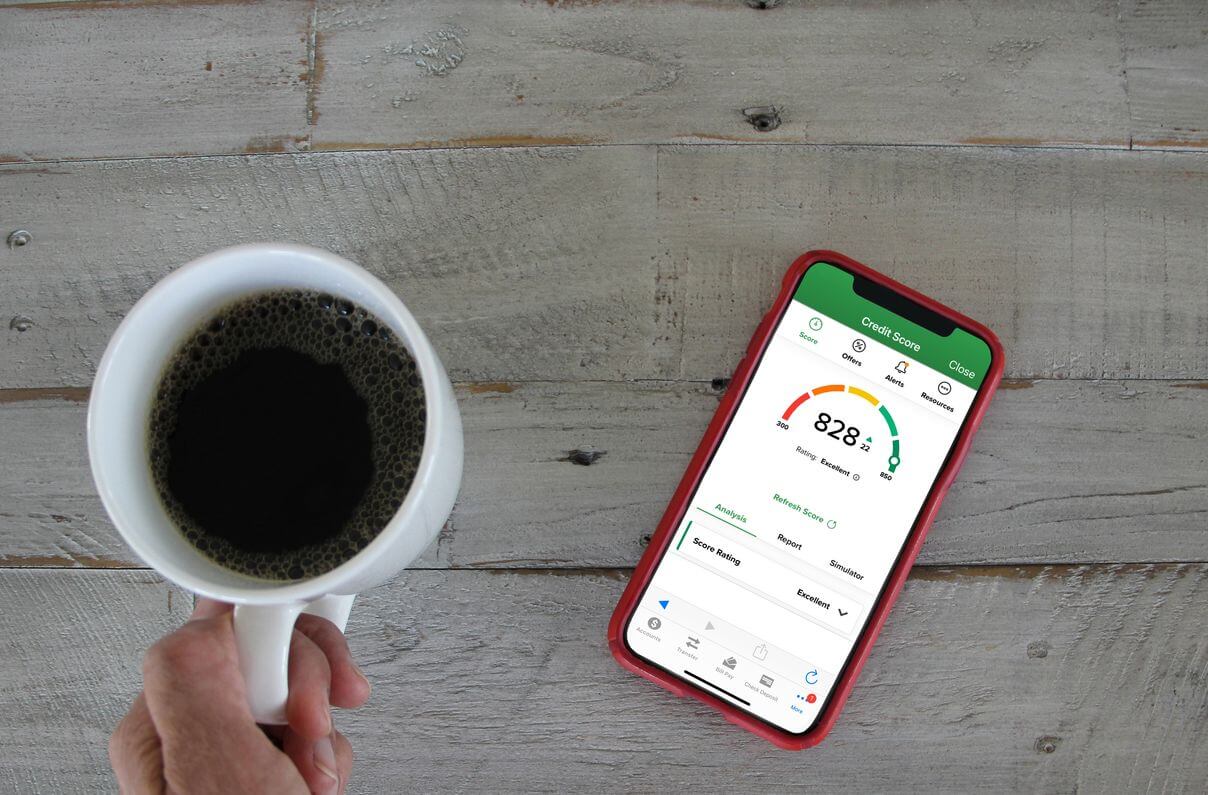

If you’re in the 99th percentile, you’ve probably heard the term “credit score” a lot. It’s hard to go a day without hearing about credit scores in the news, on TV, or even on the radio. But most people don’t know what their credit score is, or how it’s calculated. You might not know what is considered a good credit score, but you can still understand what you owe without needing an expert. Your credit report is a record of your credit history, including information about where you live, how you pay your bills, and whether you have been a good borrower. The credit report also includes your credit accounts, payment history, and creditor contact information.

If you want to maintain good credit, you need to pay your bills on time. Although this is important, it is not the only factor that matters. Carrying a balance on your credit cards, for example, can negatively impact your credit score by as much as 100 points. Your credit report lists all of your accounts and their status. A good credit report only includes accounts that are in good standing. Accounts that have been opened and then closed (such as credit cards that were used for a while but then canceled) will appear on your credit report. Therefore, deliberate efforts are necessary.

Get in touch with your creditors.

If you don’t pay your bills on time, your credit will suffer. Be sure to contact your creditors right away if you realize you can’t make a payment on time. It is in your best interest to take this action so that they will not report your delinquency to the credit bureaus, which could have a negative effect on your credit score.

Debt can be tough to keep up with, but your creditors may be willing to help. Contact them by phone, email, or in-person to let them know your situation and ask for a modification. However, be sure to follow up with creditors, as most will only negotiate for a limited time. Also, beware of scams; some people who are struggling financially may be tempted to use a debt consolidation company as a last resort.

Who can you trust in fixing your credit?

If your credit score is low, it will be more difficult to get loans, a mortgage, or even a car. A low credit score also means that when you do get credit, the interest rate will be higher. Who can repair your credit? While there are a few different ways to improve your score, the only sure-fire way to do it is by paying down your debts. To help with this, read our article “What is Credit Score?“: How They Work and How to Improve Yours. Even if you don’t have a great payment plan, there are ways to get around potential errors in records. Keep in mind that records don’t always accurately reflect reality, so there’s always a potential for mistakes.

There are many scams that sell the false promise of improving your credit score. While there are legitimate ways to improve your credit score, it takes more than just a few steps. You need to figure out where you stand and make a plan. You can get a copy of your credit report to see what is currently being reported by getting it from reputable institutions like Identity IQ. You can take advantage of their offer where you can start for $1. Then you can book for a meeting with credit repair agencies like K & C Developments, where consultation is free. If you follow the steps correctly, you should receive your credit report within 10 to 15 days. Keep in mind, that your credit report is used to calculate your credit score. If there are any inaccuracies in your report, you can work with the credit repair agency to get those corrected.

FICO, or The Fair Isaac Corporation, is a credit bureau that created the most widely used credit scoring system in the world, publishes a list of what it considers to be the major contributors to your score. Here are the top 5 factors that affect your credit scores:

1 Payment history (35%)

2 Amounts owed (30%)

3 Length of your credit history (15%)

4 New credit (10%)

5 Types of credit used (10%)

Conclusion:

While there are infinite ways to repair your credit. Focus more on the things that you can take action on immediately. This will get you started with the steep journey of building your credit, and subsequently, financial freedom.