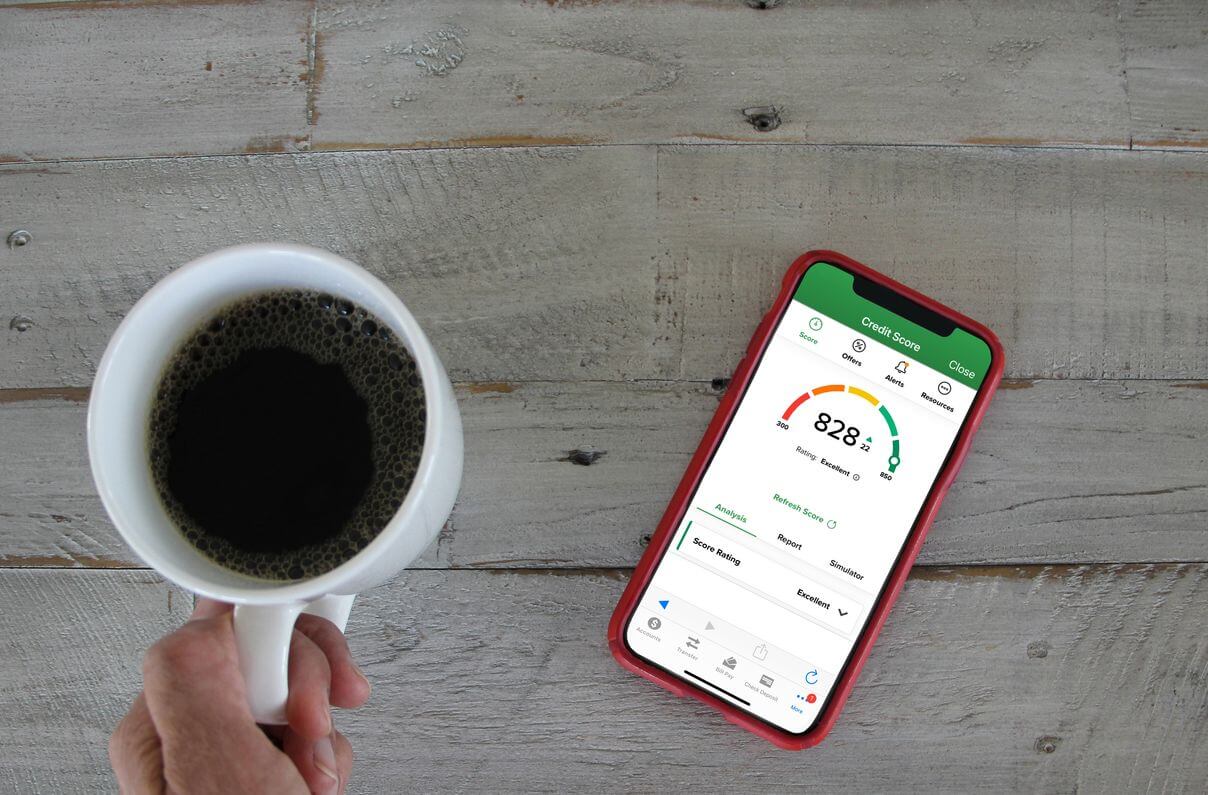

A credit score is a number that symbolizes an individual’s creditworthiness. This figure is determined based on the credit report. The credit score varies from a low 350 to a high 850. The credit score is used by lenders as one of the primary factors for approving or disapproving a loan application. A credit score is a number that symbolizes an individual’s creditworthiness. This figure is determined based on the credit report. The credit score varies from a low 350 to a high 850. The credit score is used by lenders as one of the primary factors for approving or disapproving a loan application.

Definition of Credit

What is credit? It’s simple. Have you ever heard the saying “money makes the world go round?” Well, it’s true, and there are a lot of people out there who will tell you that credit is what keeps the world turning. What you did to build up your credit score is directly responsible for the amount of money you have in your bank account today.

The word “credit” has multiple definitions. It can mean to believe in or trust someone’s words, or it can be something given in return for something else. The term “credit” can refer to something that you give or something you do in return for something else. It can also mean to believe or trust an organization like a bank. For example, you might say “I credit the bank for giving me my line of credit.”

A credit score, which is sometimes called a credit rating, is a number that reflects a person’s creditworthiness. This number is based on the information in a credit report, and it indicates a person’s ability to repay their debts. A high credit score is indicative of good creditworthiness. The main three credit reporting companies can each create a credit score for a consumer at any time, based on the information in that person’s credit file. Lenders use these scores to predict how likely people are to pay their debts on time, while others such as landlords, utility companies, employers, and insurance agencies also use them.

How do you get your Credit Score?

If you’re reading this, it’s likely because you want to know how to improve your credit score. A good credit score is important for many reasons, but many people don’t know where to start when it comes to improving their scores. You should know where your credit score is before you do anything regarding your credit score. By visiting one of the three Credit Reporting Agencies (CRAs) and requesting your report, you can easily find out your Credit Score. You can access each CRA by visiting www.annualcreditreport.com. This site gives you access to all three credit reporting agencies, so you can view your report once every 12 months for free.

Your credit score is a key indicator of your financial well-being and is used to assess your eligibility for loans, mortgages, and other forms of credit. There are various factors that contribute to your score, and it is essential to understand which ones are the most crucial.

Your credit score is one factor that lenders use to determine if you can get a loan and what interest rate you will be charged. Your credit score is a measure of your credit risk, based on your payment history, the amount you owe, and the credit limit you have. The FICO Score is the credit score that most lenders look at when deciding whether or not to extend credit and at what interest rate.

Why do you need to check your credit score?

You might have heard about it before, but many people still don’t know why they should care about their credit score and take the time to check it. However, your credit score is important because it is used to determine the interest rates you are offered for loans, credit cards, and other financial products. A higher credit score can save you money in the long run, so it is worth taking the time to check your credit score and improve it if necessary. This can be an issue because your credit score can affect your likelihood of getting a loan, renting an apartment, and even getting a job.

You can easily check your credit score and credit report for free with a Credit check assistant. You can also compare different credit cards and loans online from the comfort of your own home. You can manage your credit and loan applications, check your credit score, and stay on top of your credit history through Credit Fix Expert. If you need help, K & C Developments is here to assist you every step of the way.

How you can increase your credit score?

One of the most challenging aspects of comprehending your credit score is that there are multiple credit bureaus globally: Experian, Equifax, and TransUnion. The best way to elevate your credit score is to visit each credit bureau and confirm that all of your accounts are current. If you have any late payments, make sure the accounts are updated to show that the late payments were updated to paid.

To round up. Below are the low hanging fruits in fixing your credit that you can take action on immediately:

- Fixing errors in your credit report

- Contacting the credit bureau where ever you have a late payment

- Understanding what a credit score is and how it is calculated

- Paying off all your credit cards

- Repair late payment

- Get a credit card

- Pay your bills on time

- Consolidate your debt